new orleans sales tax rate 2020

The City of New Orleans sales tax rate on renting of any sleeping room will increase from 4 to 5. There is no applicable city tax or special tax.

New Orleans Louisiana S Sales Tax Rate Is 9 45

New Sarpy LA Sales Tax Rate.

. Council votes on the tax rates and the 2020 budget as a whole at a meeting on Thursday. What is the sales tax rate in New Orleans Louisiana. Average Sales Tax With Local.

The City of New Orleans sales tax rate on renting of any sleeping room will increase from 4 to 5. However they continue to be subject. 8 rows TaxFee Description Rate Effective Date Required Filing Tax Form.

Gail Cole Oct 15 2020. Diapers and feminine hygiene products are now exempt from half of the local sales tax in New Orleans Louisiana. New Roads LA Sales Tax Rate.

The City of New Orleans today reminded residents the deadline for the 2022 property tax payments has been extended to March 15 2022. 4 rows New Orleans LA Sales Tax Rate The current total local sales tax rate in New Orleans LA. This is the total of state parish and city sales tax rates.

Homeowners will have until March 15 to submit tax bill payments before interest accrues at 1 percent per month. Louisiana Sales Tax Small Business Guide Truic June 13 2022 504-367-2333. Before-tax price sale tax rate and final or after-tax price.

Norco LA Sales Tax Rate. New Iberia LA Sales Tax Rate. The Orleans Parish Sales Tax is 5.

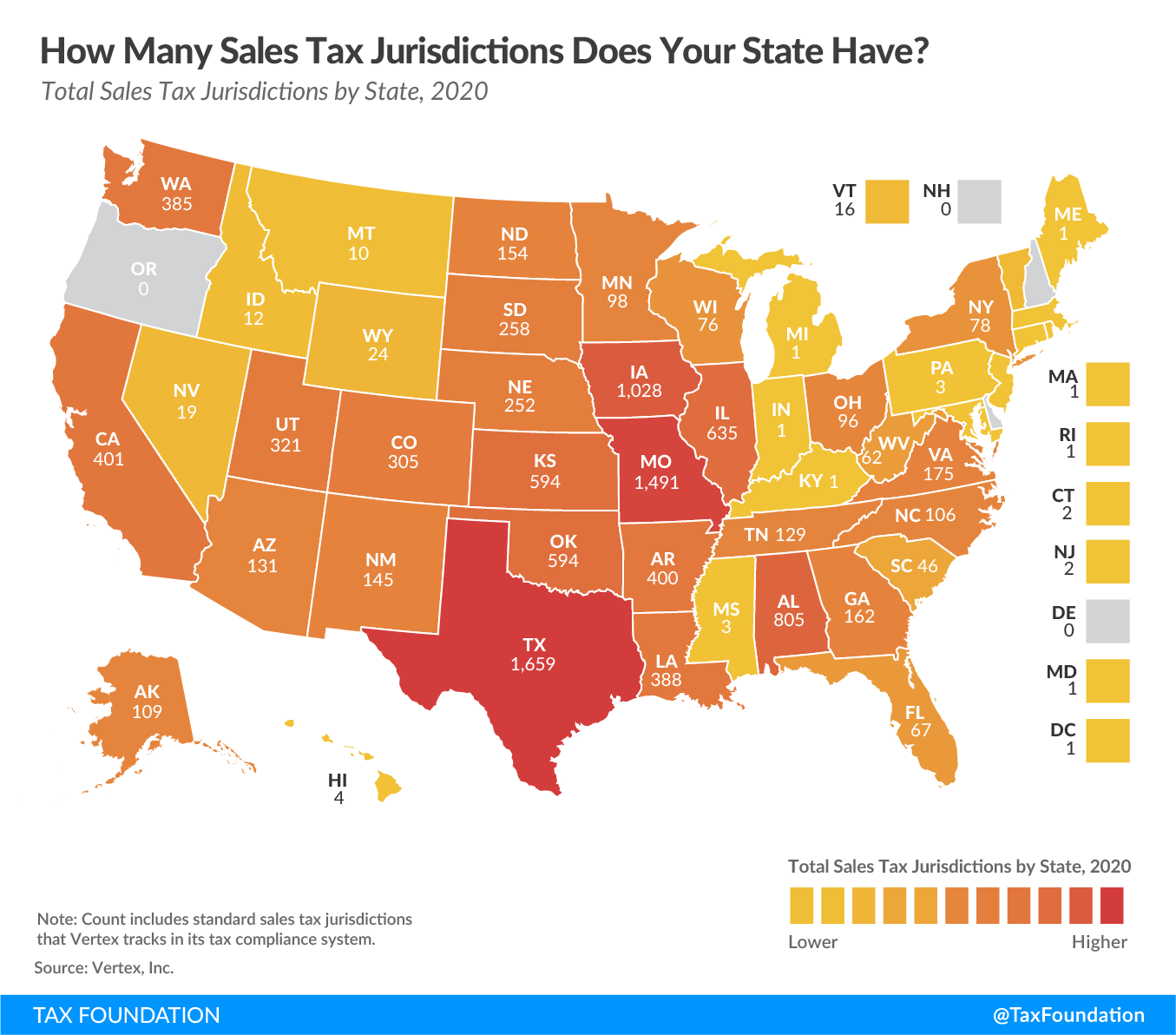

New Orleans LA Sales Tax Rate. 2020 Louisiana Sales Tax Holiday - Nobody likes paying taxes and November 20-21 2020 is an opportunity for everyone in Louisiana to pay a little less in sales taxes. Some cities and local governments in Orleans Parish collect additional local sales taxes which can be as high as 0245.

The December 2020 total local sales tax rate was also 9450. The Louisiana sales tax rate is currently. The state sales tax rate was 4 for periods prior to.

Multiply line H3 by 1175 Effective July 1 2019 5 salesuse tax rate and 675 Occupancy Tax rate effective September 1 2020. As of July 1 2018 the state sales tax rate is 445. Delivery Spanish Fork Restaurants.

Norco LA Sales Tax Rate. You can print a 945 sales tax table here. The 945 sales tax rate in New Orleans consists of 445 Louisiana state sales tax and 5 Orleans Parish sales tax.

Rate State Rate Total Rate. The definition of a hotel according to Sec. North Hodge LA Sales.

The 945 sales tax rate in New Orleans consists of 445 Louisiana state sales tax and 5 Orleans Parish sales tax. Parishwide General Sales. Prior to July 1 2018 the state sales tax rate was 5 for the period of April 1 2016 through June 30 2018.

150-874 of the City Code includes any establishment or person engaged in the business of furnishing sleeping rooms cottages or cabins to transient guests. All establishments are required to charge 5 on room rentals and. New Orleans LA Sales Tax Rate The current total local sales tax rate in New Orleans LA is 9450.

Parishwide Food Drug Sales. Noble LA Sales Tax Rate. The California sales tax rate is currently.

Did South Dakota v. Louisiana has state sales tax of 445 and. Revenue Information Bulletin 18-019.

Department of Finance Bureau of Revenue - Sales Tax 1300 Perdido St RM 1W15 New Orleans LA 70112. Avalara provides supported pre-built integration. Effective July 1 2022 diapers and feminine hygiene products are also exempt from state sales tax in Louisiana.

New Llano LA Sales Tax Rate. New Iberia LA Sales Tax Rate. 2 lower than the maximum sales tax in LA.

Negreet LA Sales Tax Rate. Newellton LA Sales Tax Rate. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

Heres how Orleans Parishs maximum sales tax rate of 9695 compares to other. The New Orleans City Council approved the the 2020 budget and slightly lowered the citys overall property tax rate at its Thursday meeting. See R-1002 Table of Sales Tax Rates for Exemptions for more information on the sales tax rate applicable to certain items.

The New Orleans sales tax rate is. 2 lower than the maximum sales tax in LA. A county-wide sales tax rate of 5 is applicable to localities in Orleans Parish in addition to the 445 Louisiana sales tax.

Table of Sales Tax Rates for Exemption for the period July 2013 June 30. The definition of a hotel according to Sec. All property tax bills for 2022 have been mailed and are also available online.

Revenue Information Bulletin 18-017. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018. The sales tax jurisdiction name is Orleans which may refer to a local government division.

Notification of Change of Sales Tax Rate for Remote Dealers and Consumer Use Tax. The Parish sales tax rate is. However they continue to be subject to a 25 city sales tax and the 445 Louisiana state sales tax rate.

Instead of a 2495 percent sales tax the new ballot initiative will be for a 245 percent tax she said. The minimum combined 2022 sales tax rate for New Orleans Louisiana is. If any excess tax collected over 1175 tax rate include on this line and check box H4A to the right.

Texas Sales Tax Guide For Businesses

State Income Tax Rates Highest Lowest 2021 Changes

Is It Possible To Buy A New Apple Device Without Any Sales Tax Appletoolbox

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Sales Tax On Grocery Items Taxjar

Internet Sales Taxes Tax Foundation

Alabama Sales Tax Guide For Businesses

Infographic New Orleans Travel Surges

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Pennsylvania Sales Tax Guide For Businesses

Louisiana Sales Tax Small Business Guide Truic

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Sales Tax Holidays Politically Expedient But Poor Tax Policy

File Sales Tax By County Webp Wikimedia Commons

Nevada Sales Tax Guide For Businesses

Internet Sales Taxes Tax Foundation

Sales Tax Rates In Major Cities Tax Data Tax Foundation

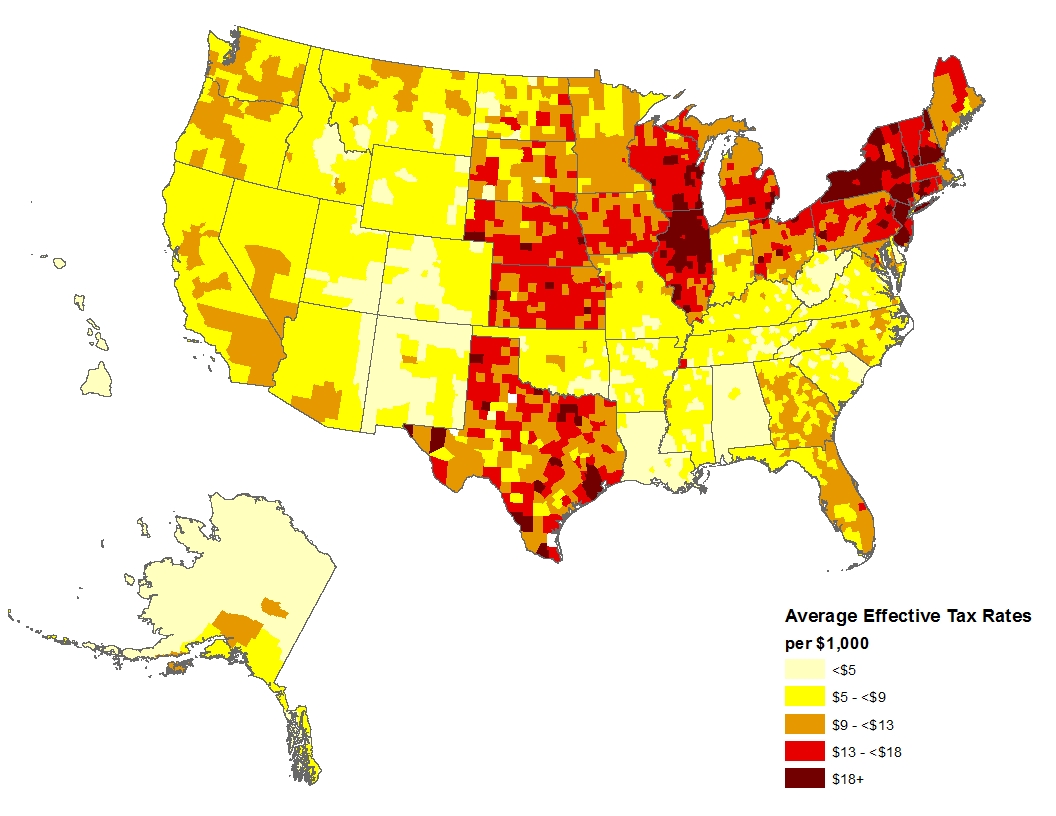

How Property Tax Rates Vary Across And Within Counties Eye On Housing