capital gains tax rate increase

Realized capital gains face a top statutory marginal income tax rate of 20 percent plus a supplemental net investment income tax rate of 38 percent for a combined total of 238. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

Long Term Capital Gains Tax How Much Tax Will I Owe Taxact Blog

Contact a Fidelity Advisor.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. Capital gains revenues did increase two years after the 1981 capital gains and general tax rate cuts as the economy recovered from the 1981-82 recession. Following the last rate increase in 2016 the capital gains of companies are included in taxable income at 80. The rates do not stop there.

With average state taxes and a 38 federal. The inclusion rates have significantly increased since. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

A 38 percent net investment tax for those making more than 200000 per. Capital Gains and Dividend Rates. Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status.

House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to. That rate hike amounts to a staggering 82 increase in the old rate. In fact recent intelligence suggests many Democrats favor a rate increase as low as 42.

In fact Bidens plan to raise the capital gains rate that wealthy Americans pay on profits from the sale of stocks or bonds from 238 to 434 is eminently reasonable and a. September 15 2021 455 PM MoneyWatch. Capital gains tax is likely to rise to near 28 rather than 396 as Joe Biden plans Goldman said.

For single tax filers you can benefit. The proposed increase would tax long-term gains over 1 million as ordinary income which means that these high-income investors would have to pay a top rate of 396. This increase will promote lock-in expand the double taxation of capital income and drive.

The Chancellor will announce the next Budget on 3 March 2021. Get more tips here. Here are more details.

2021 federal capital gains tax rates The tables below show marginal tax rates. Download 99 Retirement Tips from Fisher Investments. Capital gains tax rates on most assets held for a year or.

The tax is generally imposed on. There is currently a bill that if passed would increase the capital gains tax in. Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

Or sold a home this past year you might be wondering how to avoid tax on capital gains. Additionally a section 1250 gain the portion of a gain. The increase in the highest long-term capital gains and dividend rate is lower than that proposed by President Joe Biden who has argued for a rate of 396 percent for high.

However after the 1986. Ad If youre one of the millions of Americans who invested in stocks. Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. Short-term gains are taxed as ordinary income. Hawaiis capital gains tax rate is 725.

Unlike the long-term capital gains tax rate there is no 0. Both have proposed increasing tax rates for capital gains as one potential way to generate revenue for this purpose. Long-term capital gains or appreciation on assets held for.

Many speculate that he will increase the rates of capital gains tax to help. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent. Ad Tip 40 could help you better understand your retirement income taxes.

The effective date for this increase would be September 13 2021. Contact a Fidelity Advisor. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends.

Washington state has instituted a 7 capital gains tax on Washingtons long-term capital gains over 250000 starting January 1 2022. That applies to both long- and short-term capital gains. Long-term capital gains and qualified dividends of taxpayers with adjusted gross income AGI of more.

The proposal would increase the maximum stated capital gain rate from 20 to 25. The top federal tax rate on capital gains could reach levels not seen since the 1970s under the House Democrats proposed 35. It would be very surprising to see the capital gains rate go higher than 28.

Implications for business owners. The top capital gains tax rate will increase from 15 percent to 20 percent. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

Can Capital Gains Push Me Into A Higher Tax Bracket

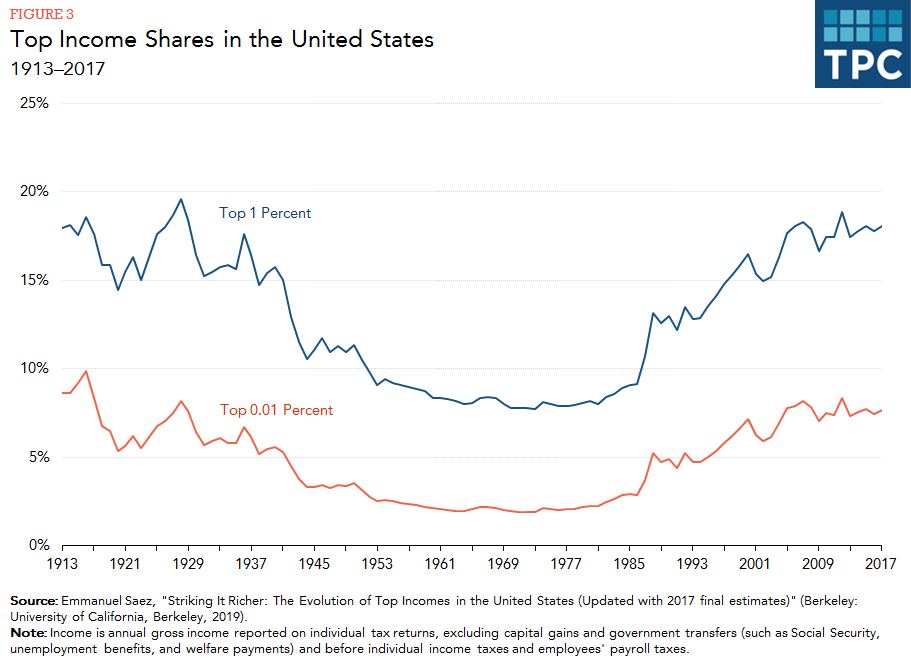

How Do Taxes Affect Income Inequality Tax Policy Center

How To Pay 0 Capital Gains Taxes With A Six Figure Income

How Do Taxes Affect Income Inequality Tax Policy Center

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

How To Save Capital Gain Tax On Sale Of Residential Property

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How The Tcja Tax Law Affects Your Personal Finances

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Selling Stock How Capital Gains Are Taxed The Motley Fool

Capital Gains Tax What Is It When Do You Pay It

How Do Taxes Affect Income Inequality Tax Policy Center

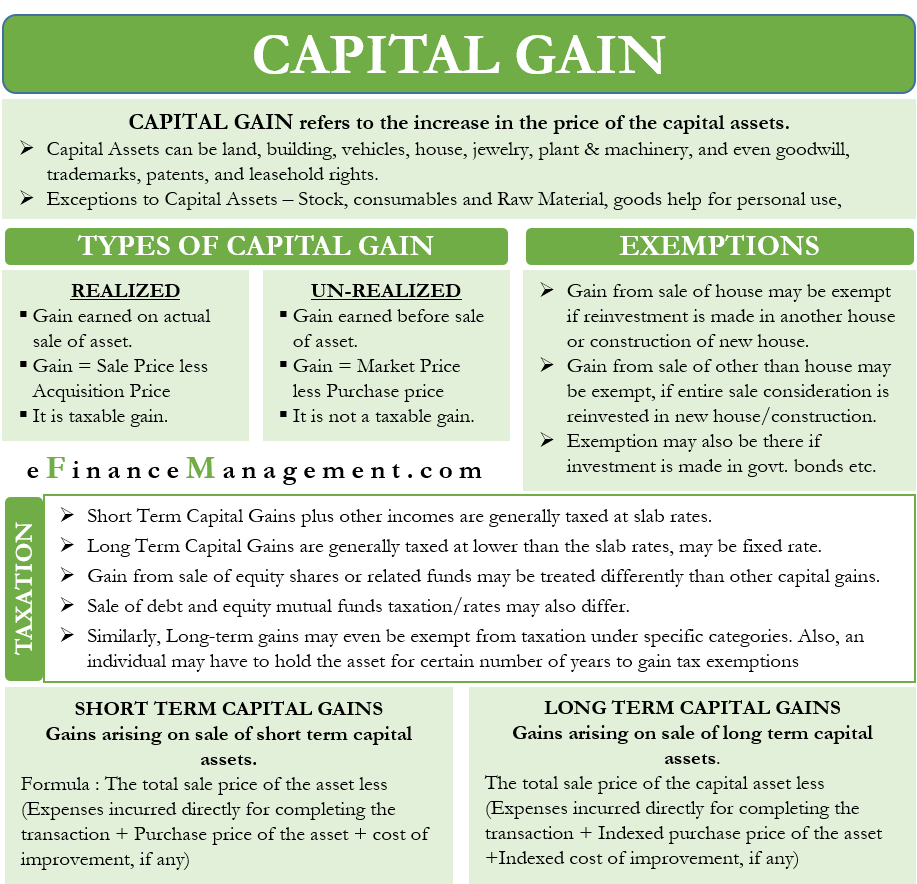

Capital Gains Meaning Types Taxation Calculation Exemptions

Difference Between Income Tax And Capital Gains Tax Difference Between

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)